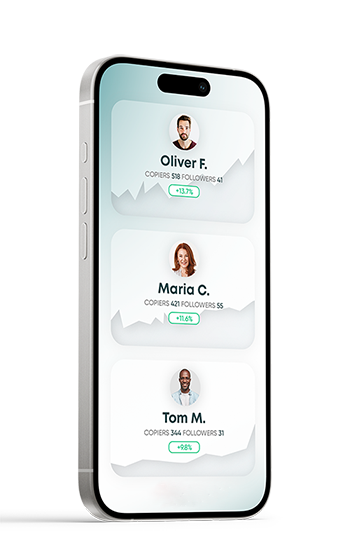

Embark on a revolutionary journey into the realm of Social Trading at ByExer.com, where innovation seamlessly merges with opportunity. Our state-of-the-art Social Trading feature is crafted to revolutionize your trading encounters, providing a platform to engage with a dynamic community of traders, exchange insights, and refine your trading strategies. Whether you're a newcomer eager to glean wisdom from seasoned experts or a seasoned trader in search of fresh perspectives, ByExer.com's Social Trading offers a diverse range of benefits for all.

Social Trading represents a groundbreaking fusion of social networking dynamics with the intricacies of financial markets. This approach facilitates interaction among traders, the exchange of valuable information, and the replication of trades executed by seasoned investors, catering to traders at every skill level. Copy trading, alternatively referred to as social trading or mirror trading, has gained significant popularity in financial markets. It involves the automatic emulation of the trading strategies and actions of proficient and successful traders. This mechanism empowers less experienced traders or investors to capitalize on the knowledge and expertise of their more skilled counterparts. Here's a typical overview of how copy trading operates:

While copy trading can offer valuable benefits to many investors, it's crucial to recognize that it comes with inherent risks. The strategies employed by the traders being copied carry their own set of risks, and it's important to understand that past performance is not a guarantee of future results. Prior to engaging in copy trading, investors should thoroughly assess their risk tolerance and conduct due diligence. Moreover, investors should be aware that some copy trading platforms may impose fees or spreads for the services they provide. Therefore, a clear understanding of the cost structure is essential before embarking on copy trading activities.